Warning

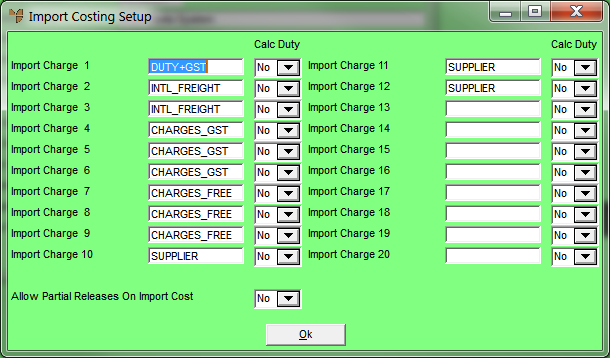

There are a number of import charges that are deemed GST free or Exempt. These charges MUST be set up in the Import Costing Setup screen as separate lines so they can be integrated separately and thus the correct BAS flags can be assigned to each transaction.